Door Prize: Excel VBA code for turning your ex-PMI into principal payments

13 Feb 2020

Table of Contents

Excited to see, with Excel, when your mortgage would be free of PMI? Let’s add a little more code showing how much you’d save if you kept paying your old “PMI bill” as “extra principal” payments every month for the rest of your loan.

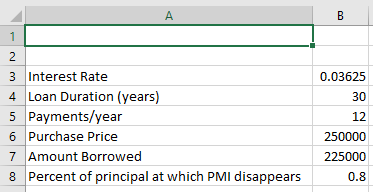

Inputs

We’ll use the same input numbers as last time:

| A | B | |

|---|---|---|

| 3 | Yearly Interest Rate | 0.03625 |

| 4 | Loan Duration (years) | 30 |

| 5 | Payments/year | 12 |

| 6 | Purchase Price | 250000 |

| 7 | Amount Borrowed | 225000 |

| 8 | Percent of principal at which PMI disappears | 0.8 |

Code to copy and paste

I’m not going to go into exactly how this works, but let’s edit our code one more time so that now Module 1 reads like this (which gives us new custom functions called GetNumberOfPaymentsMadeAfterPMIOver() and GetInterestPaidAfterPMIOver()):

Public Function GetFinalPMIMonth( _

yearlyInterestRate As Double, _

loanDurationInYears As Integer, _

paymentsPerYear As Integer, _

purchasePrice As Double, _

amountBorrowed As Double, _

percentAtWhichPMIDisappears As Double _

) As Variant

'COMMENT: Set up 4 helper variables

monthlyInterestRate = yearlyInterestRate / paymentsPerYear

totalPayments = loanDurationInYears * paymentsPerYear

principalBalanceAtWhichPMIDisappears = purchasePrice * percentAtWhichPMIDisappears

principalToPayToEliminatePMI = amountBorrowed - principalBalanceAtWhichPMIDisappears

'COMMENT: Set up loop variables

whichMonthAreWeAttempting = 1

principalPaidByEndOfAttemptedMonth = 0

'COMMENT: Do loop

While whichMonthAreWeAttempting <= totalPayments And principalPaidByEndOfAttemptedMonth < principalToPayToEliminatePMI

principalPaidByEndOfAttemptedMonth = _

-1 * _

Application.WorksheetFunction.CumPrinc( _

monthlyInterestRate, _

totalPayments, _

amountBorrowed, _

1, _

whichMonthAreWeAttempting, _

0 _

)

whichMonthAreWeAttempting = whichMonthAreWeAttempting + 1

Wend

'COMMENT: Return output value

GetFinalPMIMonth = whichMonthAreWeAttempting

End Function

Public Function GetNumberOfPaymentsMadeAfterPMIOver( _

yearlyInterestRate As Double, _

loanDurationInYears As Integer, _

paymentsPerYear As Integer, _

amountBorrowed As Double, _

paymentsAlreadyMadeWhenPMIOver As Integer, _

principalRemainingWhenPMIOver As Double, _

monthlyExtraPrincipalPayment As Double _

) As Variant

GetNumberOfPaymentsMadeAfterPMIOver = GetDetails( _

yearlyInterestRate, _

loanDurationInYears, _

paymentsPerYear, _

amountBorrowed, _

paymentsAlreadyMadeWhenPMIOver, _

principalRemainingWhenPMIOver, _

monthlyExtraPrincipalPayment _

)(0)

End Function

Public Function GetInterestPaidAfterPMIOver( _

yearlyInterestRate As Double, _

loanDurationInYears As Integer, _

paymentsPerYear As Integer, _

amountBorrowed As Double, _

paymentsAlreadyMadeWhenPMIOver As Integer, _

principalRemainingWhenPMIOver As Double, _

monthlyExtraPrincipalPayment As Double _

) As Variant

GetInterestPaidAfterPMIOver = GetDetails( _

yearlyInterestRate, _

loanDurationInYears, _

paymentsPerYear, _

amountBorrowed, _

paymentsAlreadyMadeWhenPMIOver, _

principalRemainingWhenPMIOver, _

monthlyExtraPrincipalPayment _

)(1)

End Function

Private Function GetDetails( _

yearlyInterestRate As Double, _

loanDurationInYears As Integer, _

paymentsPerYear As Integer, _

amountBorrowed As Double, _

paymentsAlreadyMadeWhenPMIOver As Integer, _

principalRemainingWhenPMIOver As Double, _

monthlyExtraPrincipalPayment As Double _

) As Variant

monthlyInterestRate = yearlyInterestRate / paymentsPerYear

totalPayments = loanDurationInYears * paymentsPerYear

principalRemaining = principalRemainingWhenPMIOver

totalInterestPaidDuringRemainingTime = 0

paymentsRemaining = totalPayments - paymentsAlreadyMadeWhenPMIOver

paymentsMadeAfterPMIOver = 0

monthlyMortgagePayment = Round(-Application.WorksheetFunction.Pmt( _

yearlyInterestRate / paymentsPerYear, _

loanDurationInYears * paymentsPerYear, _

amountBorrowed _

), 2)

While paymentsRemaining > 0 And principalRemaining > 0:

positiveInterestOwedThisPayment = principalRemaining * monthlyInterestRate

totalInterestPaidDuringRemainingTime = totalInterestPaidDuringRemainingTime + positiveInterestOwedThisPayment

monthlyPaymentAmountAvailableTowardPrincipal = monthlyMortgagePayment - positiveInterestOwedThisPayment

payThisPrincipal = monthlyPaymentAmountAvailableTowardPrincipal + monthlyExtraPrincipalPayment

If principalRemaining - payThisPrincipal < 0 Then

principalRemaining = 0

Else

principalRemaining = principalRemaining - payThisPrincipal

End If

paymentsRemaining = paymentsRemaining - 1

paymentsMadeAfterPMIOver = paymentsMadeAfterPMIOver + 1

Wend

Dim resultsArray(2) As Variant

resultsArray(0) = paymentsMadeAfterPMIOver

resultsArray(1) = totalInterestPaidDuringRemainingTime

GetDetails = resultsArray

End Function

- (Thanks to Dr. Timothy R. Mayes for getting me un-stuck when writing these functions.)

Spreadsheet rows to add

Fill out A12 through B23 as follows (note that this presumes our PMI rate is 0.3%, or 0.003 – yours may be different, so adjust accordingly):

| A | B | |

|---|---|---|

| 12 | Yearly PMI Rate | 0.003 |

| 13 | Monthly PMI payment (while applicable) | =(B7*B12)/B5 |

| 14 | Monthly total payment while on PMI | =B11+B13 |

| 15 | Principal remaining after PMI paid | =B7 + CUMPRINC(B3/B5, B4*B5, B7, 1, B9, 0) |

| 16 | Months remaining after PMI paid, if only pay monthly mortgage after PMI | =B4*B5-B9 |

| 17 | Expected interest paid to bank, long-term, if only pay monthly mortgage after PMI | =-CUMIPMT(B3/B5, B4B5, B7, 1, B4B5, 0) |

| 18 | Expected total paid to bank, long-term, if only pay monthly mortgage after PMI | =B7 + B17 |

| 19 | Expected interest paid to bank, long-term, if keep paying elevated rate after PMI | =-CUMIPMT(B3/B5, B4*B5, B7, 1, B9, 0) + GetInterestPaidAfterPMIOver(B3, B4, B5, B7, B9, B15, B13) |

| 20 | Expected total paid to bank, long-term, if keep paying elevated rate after PMI | =B7 + B19 |

| 21 | Savings, long-term, if keep paying elevated rate after PMI | =B17 - B19 |

| 22 | Months to pay off, if keep paying elevated rate after PMI | =B9 + GetNumberOfPaymentsMadeAfterPMIOver(B3, B4, B5, B7, B9, B15, B13) |

| 23 | Years+months to pay off, if keep paying elevated rate after PMI | =INT(B22/12) & " Years, " & MOD(B22,12) & " Months" |

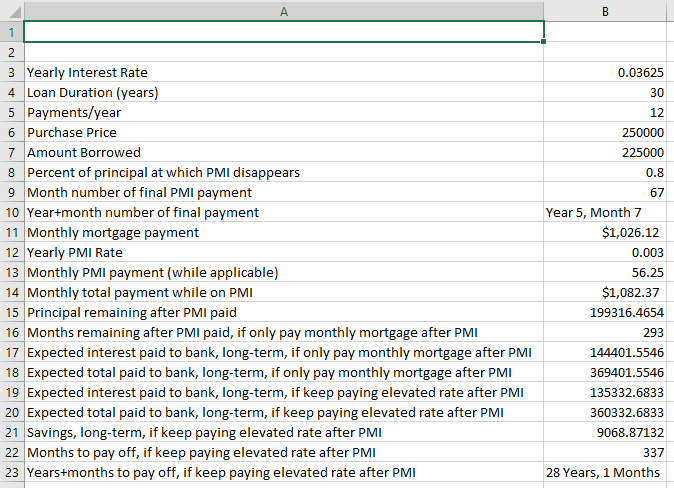

Results

Our final spreadsheet output looks like this now:

| A | B | |

|---|---|---|

| 3 | Yearly Interest Rate | 0.03625 |

| 4 | Loan Duration (years) | 30 |

| 5 | Payments/year | 12 |

| 6 | Purchase Price | 250000 |

| 7 | Amount Borrowed | 225000 |

| 8 | Percent of principal at which PMI disappears | 0.8 |

| 9 | Month number of final PMI payment | 67 |

| 10 | Year+month number of final payment | Year 5, Month 7 |

| 11 | Monthly mortgage payment | $1,026.12 |

| 12 | Yearly PMI Rate | 0.003 |

| 13 | Monthly PMI payment (while applicable) | 56.25 |

| 14 | Monthly total payment while on PMI | $1,082.37 |

| 15 | Principal remaining after PMI paid | $199,316.47 |

| 16 | Months remaining after PMI paid, if only pay monthly mortgage after PMI | 293 |

| 17 | Expected interest paid to bank, long-term, if only pay monthly mortgage after PMI | $144,401.55 |

| 18 | Expected total paid to bank, long-term, if only pay monthly mortgage after PMI | $369,401.55 |

| 19 | Expected interest paid to bank, long-term, if keep paying elevated rate after PMI | $135,332.68 |

| 20 | Expected total paid to bank, long-term, if keep paying elevated rate after PMI | $360,332.68 |

| 21 | Savings, long-term, if keep paying elevated rate after PMI | $9,068.87 |

| 22 | Months to pay off, if keep paying elevated rate after PMI | 337 |

| 23 | Years+months to pay off, if keep paying elevated rate after PMI | 28 Years, 1 Months |

Although it may be hard to keep paying an extra $56.25/month on top of the $1,026.12 still owed to the bank after clearing PMI, in the long run, you save enough to buy a used car – so think about it.

Personal finance tips

- In addition to paying down principal whenever you have extra money, also be sure to look into refinancing your mortgage if rates drop about half a percentage point or more.

- If you refinance, don’t let yourself pay the new “balance due” from the bank – you pay the bank more in the long run because you pay interest longer into the future, having “restarted the 30-year clock.”

- The simple way to remember this is: The longer you hold a loan, the longer you’re paying a bank interest for the privilege of using their money instead of yours, and they always make sure they charge you a pretty penny for that privilege.

- What you want to do after a refinance is ask the bank what “monthly payment” you would need to make to pay off your mortgage in the same calendar month/year you were already on track to pay it off in.

- If you were in “year 3” of a 30-year, ask how much you’d have to pay per month to be done in another 27 years, not 30.

- If you were in “year 22,” ask how much you’d have to pay per month to be done in another 8 years, not 15/30.

- If you don’t do this, the increased interest paid from paying the bank longer will more than outweigh the decreased interest paid from lowering your rate.

- Don’t get tempted by lower rates on 15-year mortgages unless you can really afford to be locked into paying the mortgage down incredibly quickly for the next 15 years.

- But if you were already at “year 22” of a 30-year mortgage, since you’re already planning to follow my advice to avoid “restarting the clock” and paying for any more than another 8 years, you might as well see if you can take advantage of 15-year mortgages’ good rates!

- And remember – pay it off in 8 even though the bank technically gives you 15 – lest you pay more instead of less in the long run.